indiana estate tax form

These taxes may include. A capital gain rate of 15 will apply should your taxable.

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Indiana Personal Form Categories Indiana State Tax Forms 2021.

. For your convenience we provide some of the personal form categories below. INDIANA PROPERTY TAX BENEFITS State Form 51781 R14 1-20 Prescribed by the Department of Local Government Finance THIS FORM MUST BE PRINTED ON GOLD OR YELLOW PAPER. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals.

Form IT-40 - Individual. The assessed value on the Form 11 is. Form to be filed by executors of an estate and other persons required to file Form 706 or Form 706-NA to report the final estate tax value of property distributed or to be.

Property tax forms are managed by the Indiana Department of Local Government Finance not the. If you need to contact the IRS you can access. APPLICATION FOR PROPERTY TAX EXEMPTION State Form 9284 R10 11-15 Prescribed by Department of Local Government Finance Assessment date January 1 20____ County Name of.

But even though Indiana may not have an. Of all the states Connecticut has the highest exemption amount of 91 million. Ad Instantly Find and Download Legal Forms Drafted by Attorneys for Your State.

Instantly Find Download Legal Forms Drafted by Attorneys for Your State. We will update this page with a new version of the form for 2023 as soon as it is made available by the Indiana. The Indiana income tax rate for.

Inheritance tax was repealed for individuals dying after Dec. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. Income Tax Return for Estates and Trusts before you begin filling out Indianas Form IT-41.

For more information please join us for an upcoming FREE seminar. If you have a simple state tax return you can file an IT-40 EZ form instead of the regular Form IT-40. Instructions for Completing Form WH-4 This form should be completed by all resident and nonresident employees having income subject to Indiana state andor county income tax.

The Notice of Assessment of Land and Improvements Form 11 is an assessment notice that is sent to taxpayers by the county or township assessor. If you have additional questions or concerns about estate planning and taxes contact an experienced. The final income tax.

Use this form to initiate a property tax appeal with your Indiana county. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

This is great news if you live in the Hoosier state. Forms downloaded and printed from this page may be used to file taxes unless otherwise specified. Level and file Form IT-41 at the Indiana level.

Indiana home sellers need to understand how these rate limits on capital gains taxes will affect their investment. This list should include any real estate. Therefore you must complete federal Form 1041 US.

Many of the necessary determinations are done at the federal level by the IRS. A Current Assets List can be used when planning the distribution of an individuals estate. Printable Indiana state tax forms for the 2021 tax year will be based on income earned between January 1 2021 through December 31 2021.

Ad The Leading Online Publisher of National and State-specific Legal Documents. Federal tax forms such as the 1040 or 1099 can be found. Form IT-40 EZ - Simple Income Tax Return.

The personal representative of an estate in Indiana must continue to pay the taxes owed by the decedent and his or her estate. We offer thousands of Indiana forms. Ad Download Or Email Probate More Fillable Forms Register and Subscribe Now.

The estate tax rate is based on the value of the decedents entire taxable estate. Indiana is one of 38 states in the United States that does not have an estate tax. Indiana Current Year Tax Forms.

This form is for income earned in tax year 2021 with tax returns due in April 2022. Step 3 Make a List of All Estate Items. Therefore you must complete federal Form 1041 US.

No inheritance tax returns Form IH-6 for. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

Contract To Sell On Land Contract Real Estate Contract Real Estate Forms Things To Sell

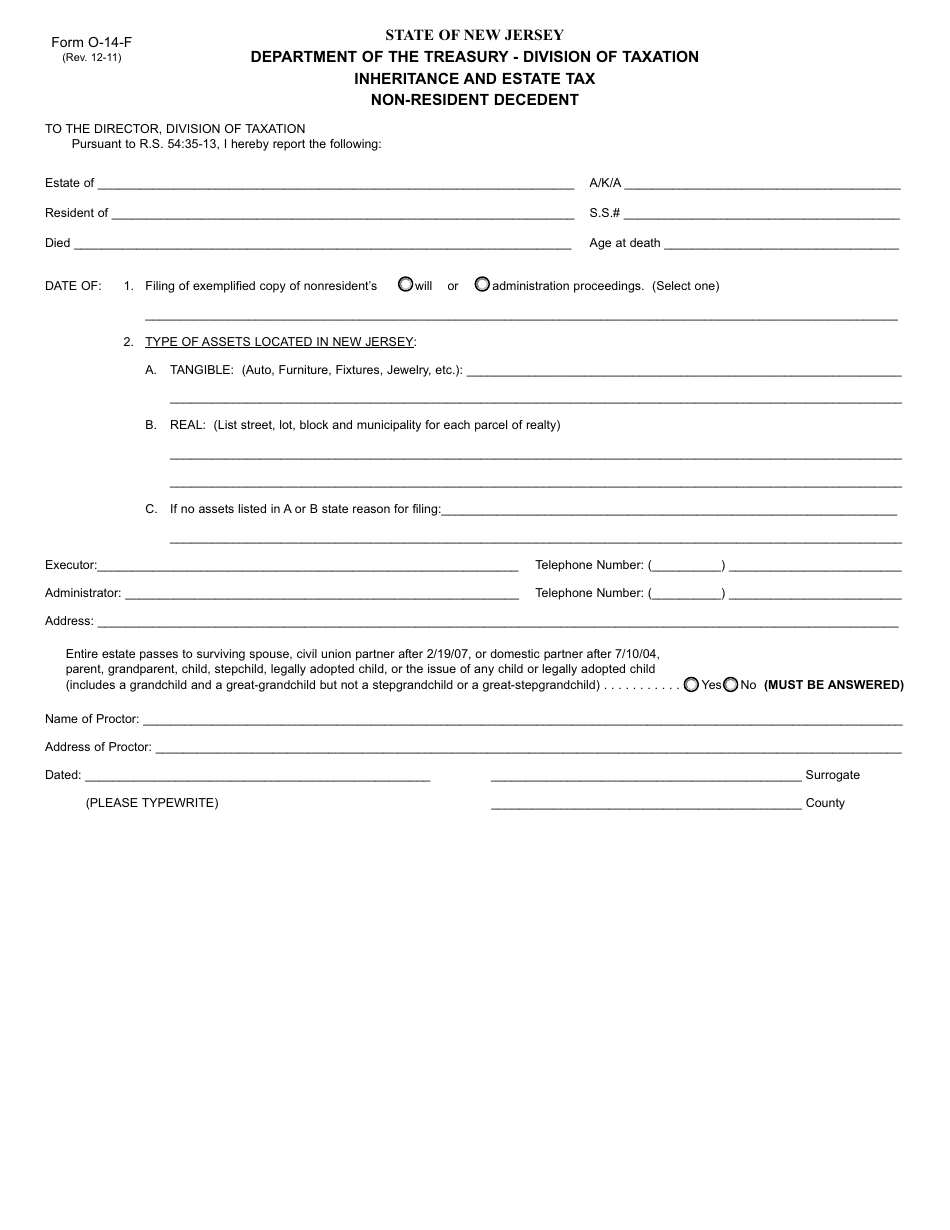

Form O 14 F Download Fillable Pdf Or Fill Online Inheritance And Estate Tax Non Resident Decedent New Jersey Templateroller

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

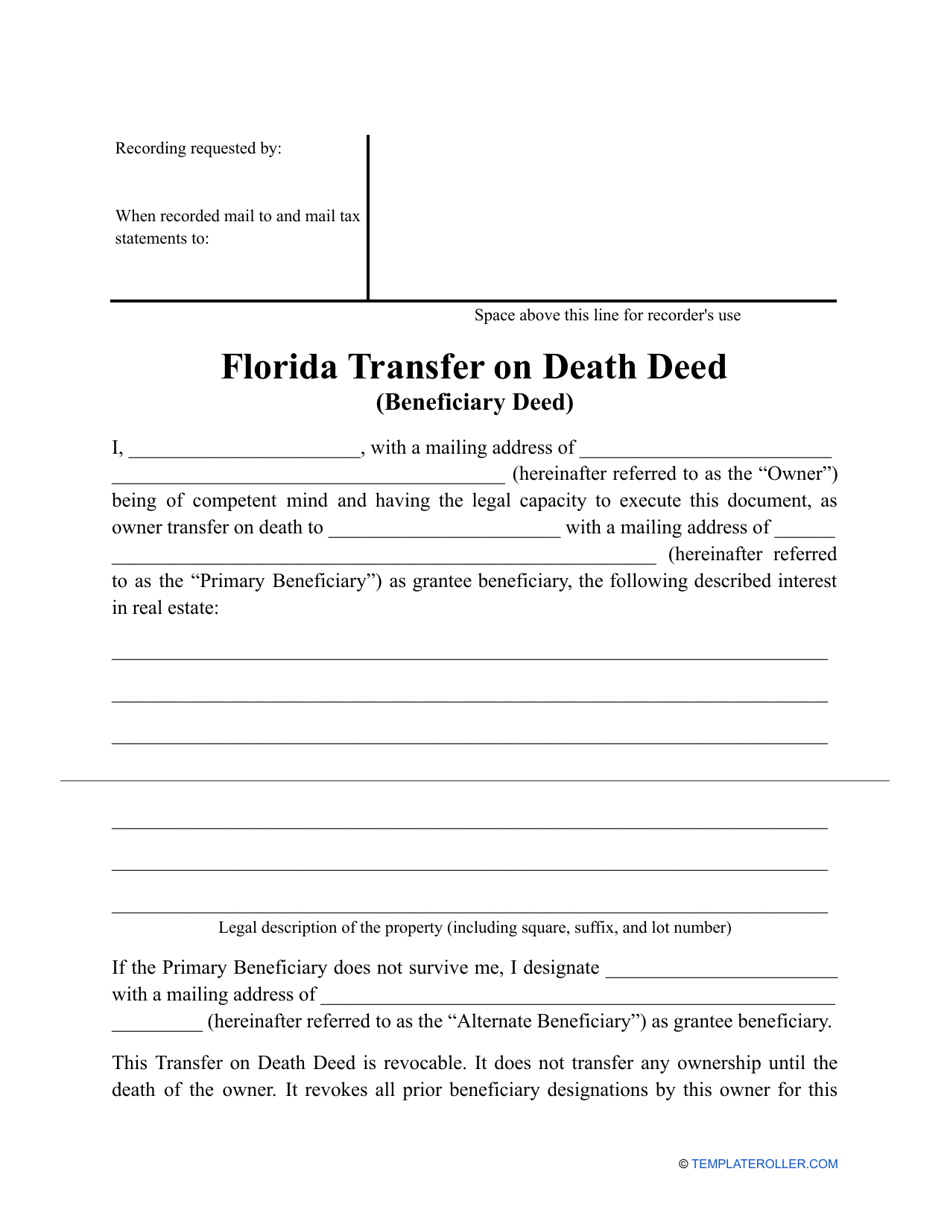

Florida Transfer On Death Deed Form Download Printable Pdf Templateroller

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

How Long Does A Speeding Ticket Stay On Your Record D Turner Legal Llc Speeding Tickets Records Ticket

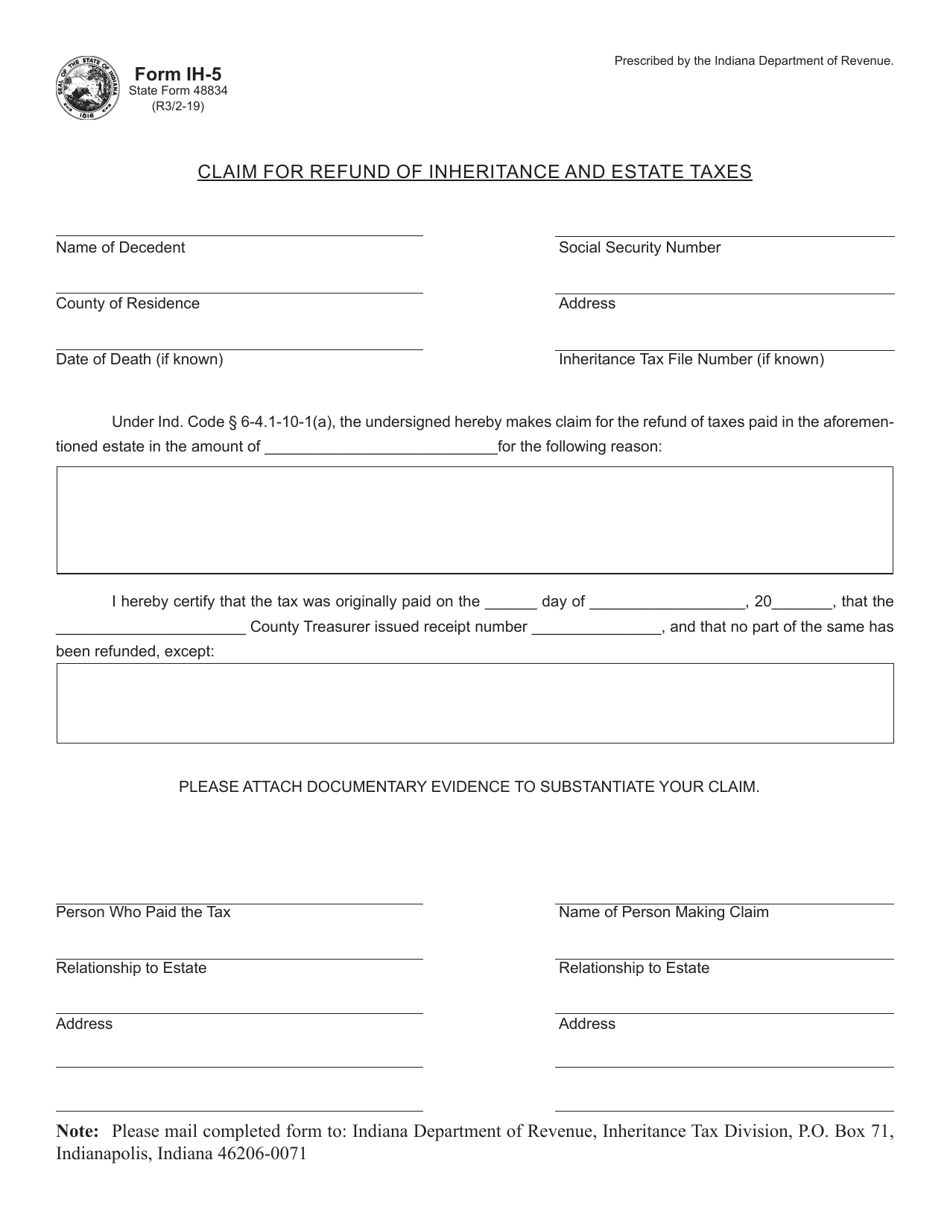

Form Ih 5 State Form 48834 Download Fillable Pdf Or Fill Online Claim For Refund Of Inheritance And Estate Taxes Indiana Templateroller

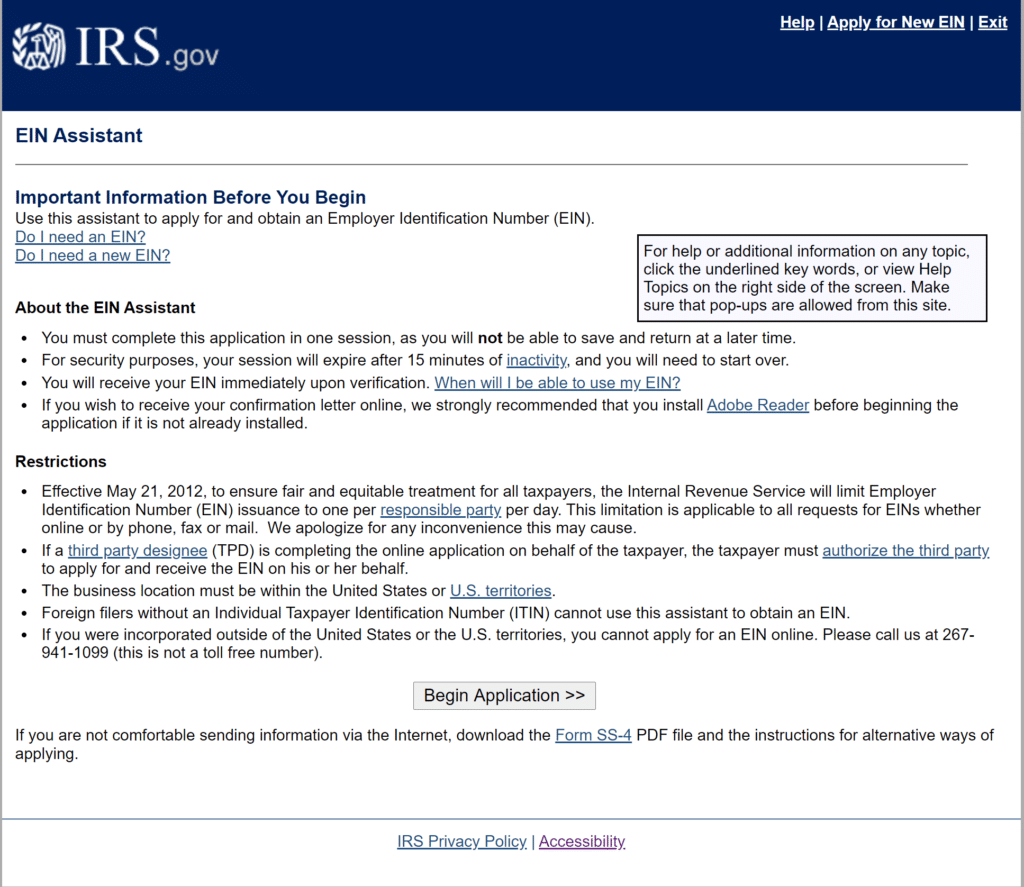

How To Apply For An Estate Ein Or Tin Online 9 Step Guide

Illinois Quit Claim Deed Form Quites Illinois The Deed

Basics Of Estate Planning Trusts And Subtrusts American Academy Of Estate Planning Attorneys Estate Planning Estate Planning Attorney Revocable Living Trust

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

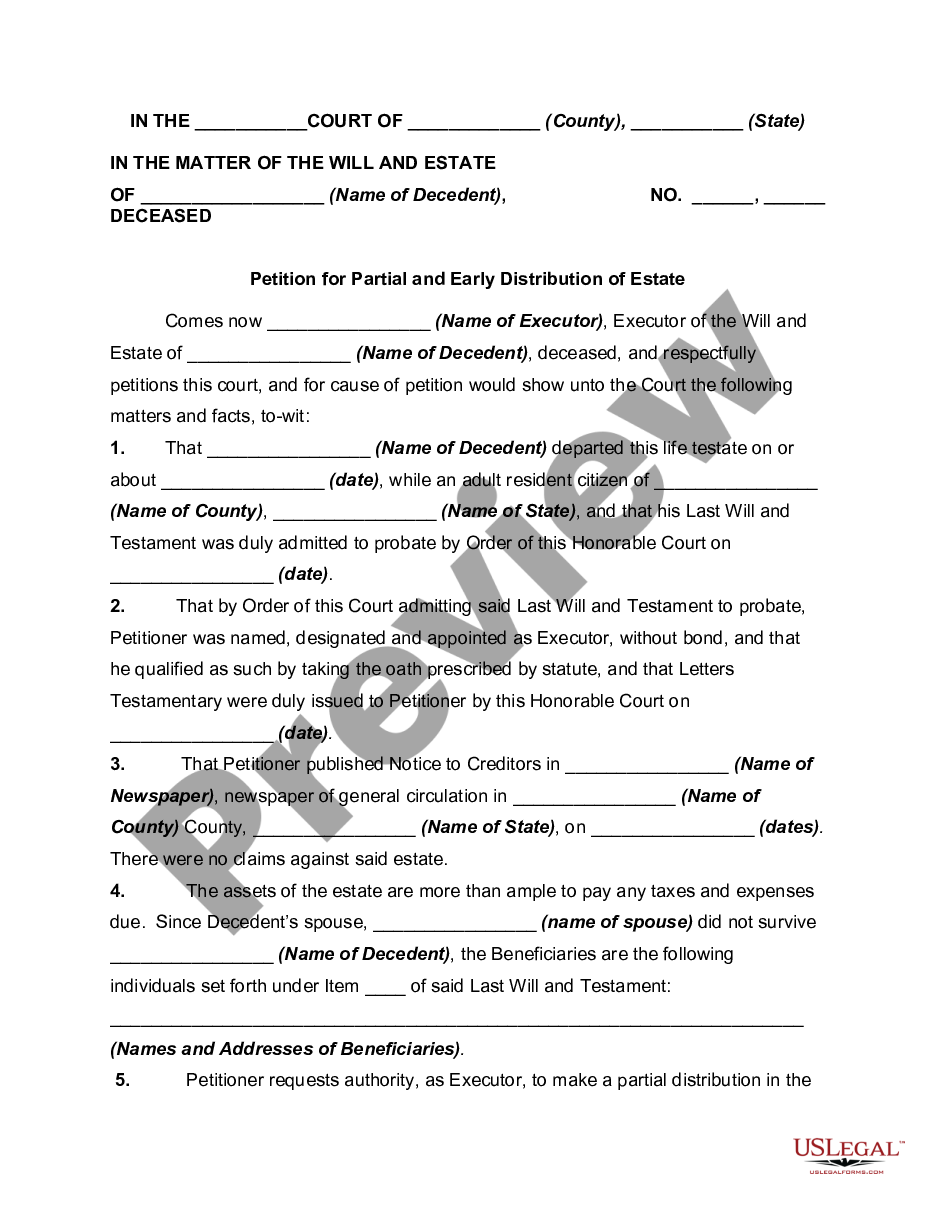

Petition For Partial And Early Distribution Of Estate Partial Distribution Of Estate Form Us Legal Forms

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

Irs Form 56 Instructions Overview Community Tax

Kentucky Quit Claim Deed Form Quites Quitclaim Deed Kentucky

3 11 106 Estate And Gift Tax Returns Internal Revenue Service